In the United States, most commercial and industrial (C&I) lending takes the form of revolving lines of credit, known as revolvers or credit lines. For decades, like other U.S. C&I loans, credit lines were typically indexed to the London Interbank Offered Rate (LIBOR). However, since 2022, the U.S. and other developed-market economies have transitioned from credit-sensitive reference rates such as LIBOR to new risk-free rates, including the Secured Overnight Financing Rate (SOFR). This post, based on a recent New York Fed Staff Report, explores how the provision of revolving credit is likely to change as a result of the transition to a new reference rate.

Revolving Credit and Bank Funding Risk

As of January 10, 2021, the twenty largest U.S. bank holding companies had around $2 trillion of credit line commitments, of which approximately $1.5 trillion were committed but remained undrawn. Credit lines give companies the option to borrow funds at a pre-agreed fixed spread over a floating reference rate. When borrowers draw on their lines, banks need to source the required cash—sometimes by borrowing in wholesale funding markets. Because credit line drawdowns tend to be larger when funding markets are stressed, the provision of revolving credit is associated with a funding risk.

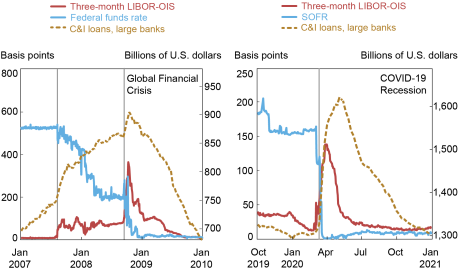

During the global financial crisis (GFC) and the COVID recession, firms drew heavily on their credit lines and bank wholesale funding costs rose sharply, while risk-free rates fell. Our measure of bank funding spreads is the difference between three-month LIBOR and the three-month overnight index swap (OIS) rate, or LIBOR-OIS, which peaked at 130 basis points during the COVID shock and reached nearly 350 basis points after Lehman’s failure (see both panels below). At the same time, corporate lending increased by 20 percent at the beginning of the COVID pandemic in March 2020 and by about 6 percent following Lehman’s failure. In both periods, the increase in C&I lending was almost entirely caused by drawdowns of existing credit lines, mostly to large corporate borrowers. This correlation between line draws and bank funding costs is key to understanding the impact of reference rate transition on the provision of revolving lines of credit: the greater the covariance between these two key variables, the higher the expected cost to bank shareholders of providing credit lines.

Increase in Bank Funding Costs and Corporate Draws during the Global Financial Crisis and COVID

Notes: The panels plot bank funding rates and large bank C&I lending during the global financial crisis and the COVID-19 shock. Vertical lines mark important dates for the crises (left to right: BNP Paribas freezes funds citing problems with subprime mortgages, Lehman Brothers files for bankruptcy; World Health Organization declares COVID-19 a pandemic).

Credit-Sensitive Reference Rates and Credit Supply

Linking revolvers to credit-sensitive rates like LIBOR discourages borrowers from drawing on their credit lines when bank funding costs are high. In contrast, risk-free reference rates typically fall when markets are stressed, increasing the incentive for borrowers to draw on their lines. Thus, the transition to risk-free reference rates increases the covariance between line draws and bank funding spreads. This could raise the cost to bank shareholders of offering revolvers. In September 2019, a collection of banks wrote to bank regulators, stating:

“. . . The natural consequence of these forces will either be a reduction in the willingness of lenders to provide credit in a SOFR-only environment, particularly during periods of economic stress, and/or an increase in credit pricing through the cycle. In a SOFR-only environment, lenders may reduce lending even in a stable economic environment, because of the inherent uncertainty regarding how to appropriately price lines of credit committed in stable times that might be drawn during times of economic stress.”

In our Staff Report, we analyze a theoretical model of revolving credit provision and find that the choice of reference rates impacts the provision of credit lines. We show theoretically that bank funding of credit line draws reduces the market value of bank equity, a form of debt overhang. The debt overhang arises as bank shareholders bear a disproportionate share, relative to existing bank debt holders, of the interest expense for funding line draws by borrowing new funds. This cost to bank shareholders is larger if credit lines are drawn when bank funding costs are high relative to risk-free rates. Banks will price these anticipated debt-overhang costs into credit lines at origination. However, the increased cost to bank shareholders of offering revolvers is smaller if (1) reference rates are credit-sensitive, reducing borrowers’ incentives to draw heavily under stressed market conditions, or (2) banks expect funding costs to be lower because some of the drawn funds will be left on deposit.

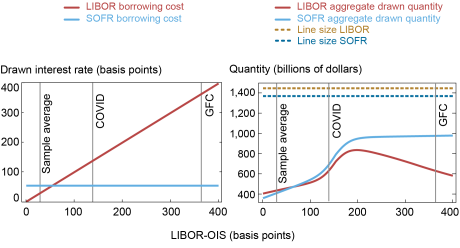

We calibrate our model to show that, to the extent that debt overhang increases the cost to borrowers of obtaining revolvers, borrowers react by choosing smaller credit-line limits. In our baseline calibration, shown in the right panel of the chart below, we find that transitioning from LIBOR to SOFR implies a reduction of about 5 percent in aggregate credit line commitments. Further, while our model predicts a moderate decline in expected drawdowns of 3 percent, we find that the transition will drastically alter when credit lines are used. We find that during normal times, when bank funding spreads and LIBOR-OIS are low, the reference rate transition reduces line draws because the drawn interest rate is higher under SOFR than it would be under LIBOR (left panel of the chart). By contrast, during times of financial distress, when LIBOR-OIS rises sharply relative to SOFR, borrowers draw significantly more credit on SOFR-linked lines than they would on LIBOR-linked lines. For instance, we find that for episodes with funding spreads at the level attained during the GFC, drawdowns would be around 67 percent higher under SOFR than under LIBOR.

Effect of the LIBOR-SOFR Transition on Credit Line Prices, Aggregate Drawn Quantities, and Aggregate Credit Line Commitments

Notes: All parameters are as specified in the accompanying Staff Report. The horizontal dashed-dotted lines in the right panel indicate the sizes of the credit lines. Vertical lines are shown at the sample average of LIBOR-OIS (28 basis points), at the level of LIBOR-OIS reached in the COVID-19 shock of March 2020 (140 basis points), and at the level of LIBOR-OIS reached during the global financial crisis (360 basis points). The left panel shows interest rates while the right panel shows quantities drawn and/or committed.

In our calibrated model, the representative bank prices this behavior into the terms of new credit lines, and consequently the expected cost of drawn credit increases by roughly 15 basis points. The corresponding welfare loss (as measured by the sum of bank profit and borrower utility) is about 3 percent. For our representative bank, a welfare-maximizing reference rate has about 80 percent of the credit sensitivity of LIBOR. The welfare-maximal reference rate is estimated to be much closer to SOFR for banks with much lower funding costs than the representative bank in our calibration. Note that our estimates of the effects of the transition are sensitive to assumptions about important model parameters, such as the elasticity of credit demand and the likelihood of financial distress.

Bank Heterogeneity and the Role of Deposit Inflows

During the GFC, corporate borrowers drew heavily on their credit lines without depositing much of what they drew, forcing banks to raise funds at high credit spreads. However, if a significant portion of drawdowns is expected to be left on deposit at the same bank, then the expected cost to bank shareholders of providing revolvers is reduced, because corporate deposits are typically a cheap source of bank funding, even in stressed markets. To the extent that banks anticipate cheap deposit funding of line draws, they will offer revolvers at correspondingly cheaper pricing terms.

When the COVID shock occurred, large U.S. banks funded the bulk of drawdowns from relatively inexpensive sources. Across the banks in our sample, 89 percent of total corporate drawdowns were left on deposit—a very cheap source of funding. However, low-cost deposit funding of credit line draws was prevalent only among the very largest U.S. banks. At the regional banks in our sample, we estimate that only 42 percent of line draws were left on deposit. These banks turned to Federal Home Loan Banks (FHLBs) for about 40 percent of the funding needed to cover draws on revolvers. FHLB funding, while more expensive than corporate deposits, was nevertheless available at rates significantly lower than LIBOR.

In our baseline calibration, the representative bank funds drawdowns primarily, but not entirely, with wholesale unsecured borrowing. We see in the chart below that if banks expect that a larger fraction of line draws will be left on deposit, credit provision could actually increase with the transition to SOFR, both in terms of line sizes and expected amounts drawn. By contrast, if banks expect relatively little or none of the line draws to be left on deposit—more akin to the GFC experience and less than assumed in our baseline calibration—then the reference rate transition could lead to a larger decrease in credit provision than is suggested by our baseline calibration.

The Effect of Increasing the Maximal Fraction of Drawdown Deposited

Notes: All parameters are as specified in our accompanying Staff Report. We vary the amount of expected drawdowns that is re-deposited along the x-axis. From left to right, the panels depict the impact on aggregate line limits (in billions of dollars), the expected aggregate drawdown (in billions of dollars), and the spread over the reference rate (in basis points).

Our results also imply that the reference rate transition will lead banks with low costs for funding line draws to increase spreads on revolvers by less than banks with higher funding costs. Given variation in historical funding spreads and deposit inflows, our findings thus suggest differential impacts of the reference rate transition on regional banks relative to the largest U.S. banks.

Wrapping Up

Our results suggest that the transition from credit-sensitive reference rates like LIBOR to risk-free reference rates such as SOFR is likely to increase expected borrowing costs on revolving lines of credit. This impact is smaller for banks with lower funding spreads, or even reversed if the deposit inflows that are anticipated under stressed market conditions are sufficiently large. Empirically, we find that during the COVID shock, the extent to which line draws were left on deposit was much lower at regional U.S. banks than at the largest U.S. banks. Because of this, the reference rate transition could impact the provision of credit lines more for regional U.S. banks than for the largest U.S. banks. It is therefore not surprising that regional banks wrote to bank regulators in 2019 about their concerns over the reference rate transition.

Our findings should not be interpreted as suggesting that a transition away from LIBOR has negative overall benefits. It is well documented that LIBOR is not a trustworthy benchmark funding rate, given how it was manipulated and the paucity of transactions data that was used to determine LIBOR, especially under stressed market conditions. Our analysis, however, suggests that when debt overhang costs associated with funding credit line drawdowns are high, C&I lending could be higher and borrowing costs could be lower under a credit-sensitive reference rate than under a risk-free reference rate.

Harry Cooperman is a Ph.D. student in finance at Stanford Graduate School of Business and a former senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Darrell Duffie is the Adams Distinguished Professor of Management and Professor of Finance at Stanford Graduate School of Business, and currently resident scholar at the Federal Reserve Bank of New York.

Alena-Kang Landsberg is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Stephan Luck is a financial research advisor in Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Zachry Wang is a Ph.D. student in finance at Stanford Graduate School of Business.

Yilin (David) Yang is an assistant professor of finance at City University of Hong Kong.