We have unfortunately experienced three major, yet largely unexpected bank failures this past Spring. Importantly, they were not related to outsize credit losses, nor inadequate capital, which have been the proximate causes of most such calamities in the past. Instead, they were rooted in a gross bank “asset/liability management” (ALM) failure. Surprisingly, I think it is fair to say this was not appreciated nor adequately foreseen by either bank managements or their regulators in a timely way.

Disturbingly, I believe another unfortunate banking crisis can easily happen again if banks now begin to utilize SOFR as their primary basis to price loans following the demise of LIBOR. SOFR is already proliferating rapidly in bank loan pricing.

SOFR is an appropriate and respected index for derivative markets, whose size and function vastly dwarf the bank credit market. But it is not an appropriate index for bank credit, and if it prevails in this function, it can create another tragic ALM failure that could arise with little warning. Especially during times of economic weakness or malaise that triggers a flight-to-quality, when bank credit is most critically needed.

Why is this? Because while SOFR impeccably measures the risk-free rate of government funding, LIBOR – with its faults – at least measured the risk in funding bank credit, the far more relevant variable. They aren’t the same. And they can quickly become cyclically opposite.

Government funding rates (and, therefore SOFR) always drop sharply during periods of flight-to-quality. Accompanying this, bank funding costs will instead be rising, but bank loan portfolios based on SOFR will sharply reprice down. Gross loan margins will not only be quickly compressed, they could even become negative, at a time when bank earnings are also being hammered by higher funding costs and high loan losses. Economists would call this “pro-cyclicality,” or a worsening in an already stressed credit cycle.

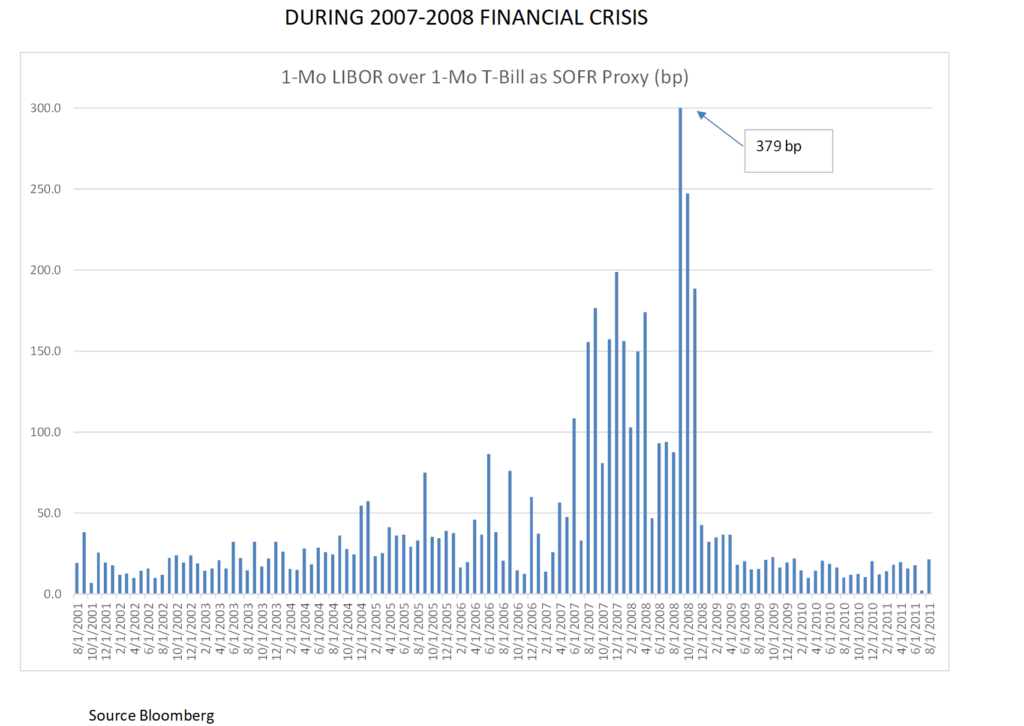

We can help quantify this damage. During the 2007-08 crisis LIBOR-based loan rates actually went up as they should, as that index was credit-sensitive, while Treasury rates fell sharply. The gap between the two quickly widened to over 200 basis points, and briefly exceeded 300 basis points! Therefore, had the SOFR index been in use instead of LIBOR during that crisis, loan portfolio spreads would have fallen sharply, significantly damaging net loan revenues and bank credit creation. This dichotomy lasted 18 months.

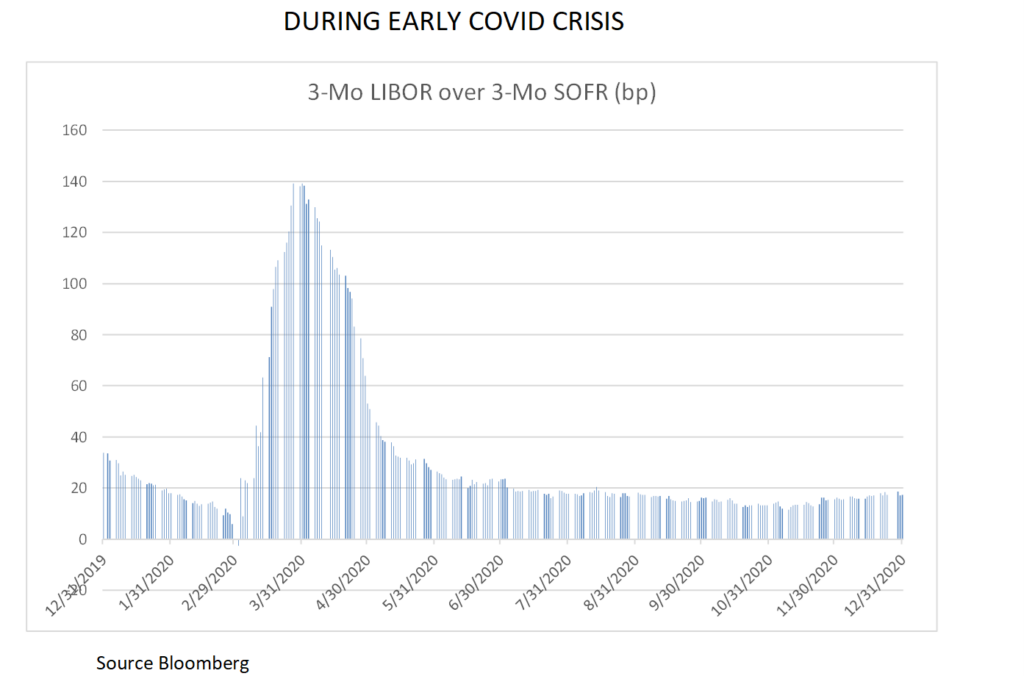

A more recent and similar disruption occurred during the onset of COVID in March of 2020, when SOFR fell 122 basis points while LIBOR rose 68bp, a punishing 190 basis point loss in comparative loan yields. (See graphics below.) Fortunately, this disruption lasted only two months.

Bankers across the nation have told me that bank examiners, in a perhaps myopic fervor for “uniformity,” are still criticizing the use of any credit sensitive rate (CSR) index for loan pricing, pressuring the use of SOFR. This is an inadvertently unsafe and unsound banking practice in my view. SOFR does not properly replace LIBOR for bank credit pricing.

Bank managements need to use CSRs to avoid another banking crisis, and bank regulators need to encourage this shift. Failing this, at a minimum, banks need to return to prime rate loan pricing. While the prime rate has historically been tied to the Effective Fed Funds rate, it utilizes a movable spread above that rate – currently 325 basis points — leaving bank managements the ability to at least widen that spread during a crisis or an unanticipated rise in funding costs.

Allowing SOFR to dominate bank loan pricing not only risks considerable damage to banking system health and profitability, but it will arguably cause banks to sharply restrain credit when the economy needs it most.